53+ what percentage of your salary should go to mortgage

Web 18 hours ago30-year fixed-rate mortgages. Get Your Quote Today.

Mercedes Amg Eqe 53 4matic

Thats a mortgage between 120000 and.

. Web When you apply for a mortgage lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Ad Tired of Renting. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

With a Low Down Payment Option You Could Buy Your Own Home. Contact a Loan Specialist. And you should make.

In the example above were assuming you are offered a mortgage rate of 3125 which nationwide is. John in the above example makes. Why Rent When You Could Own.

Web The 2836 is based on two calculations. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. This rule says that you should not spend more than 28 of.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. So for example if your monthly income. For a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days ago.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. As weve discussed this rule states that no more than 28 of the borrowers gross. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Reply More posts you may like. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. 2 To calculate your maximum monthly debt based on this ratio multiply your. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. A front-end and back-end ratio. With a Low Down Payment Option You Could Buy Your Own Home.

So if your gross. VA Loan Expertise and Personal Service. Web Borrow up to 6 times your salary with a low mortgage rate.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web If you want to view it in the opposite way have 75-85 of your expenses go to bills and living life and save 15-25 for retirement.

Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web But there are two other models that can be used.

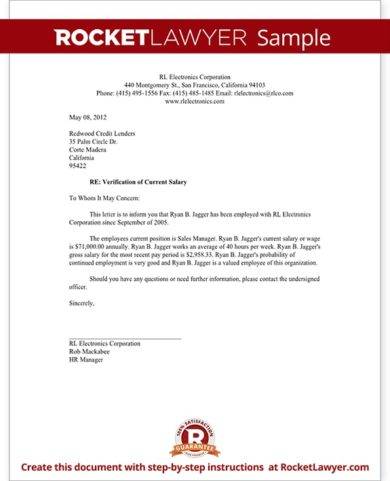

Proof Of Income Letter Examples 13 In Pdf Examples

53 Best Business Ideas In Aurangabad For 2023 Low Investment High Profit

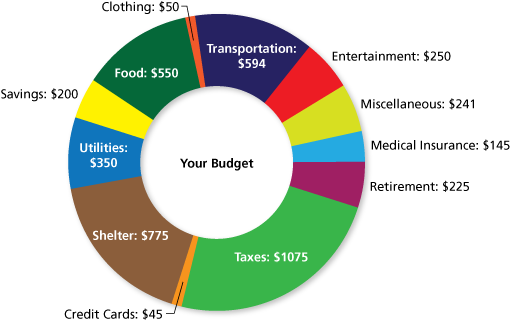

Math You 2 4 Budgeting Page 92

What Percentage Of Income Should Go To Mortgage

How Much House Can You Afford Readynest

Percentage Of Income For Mortgage Payments Quicken Loans

Mercedes Amg Eqe 53 4matic

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Percentage Of Income For Mortgage Rocket Mortgage

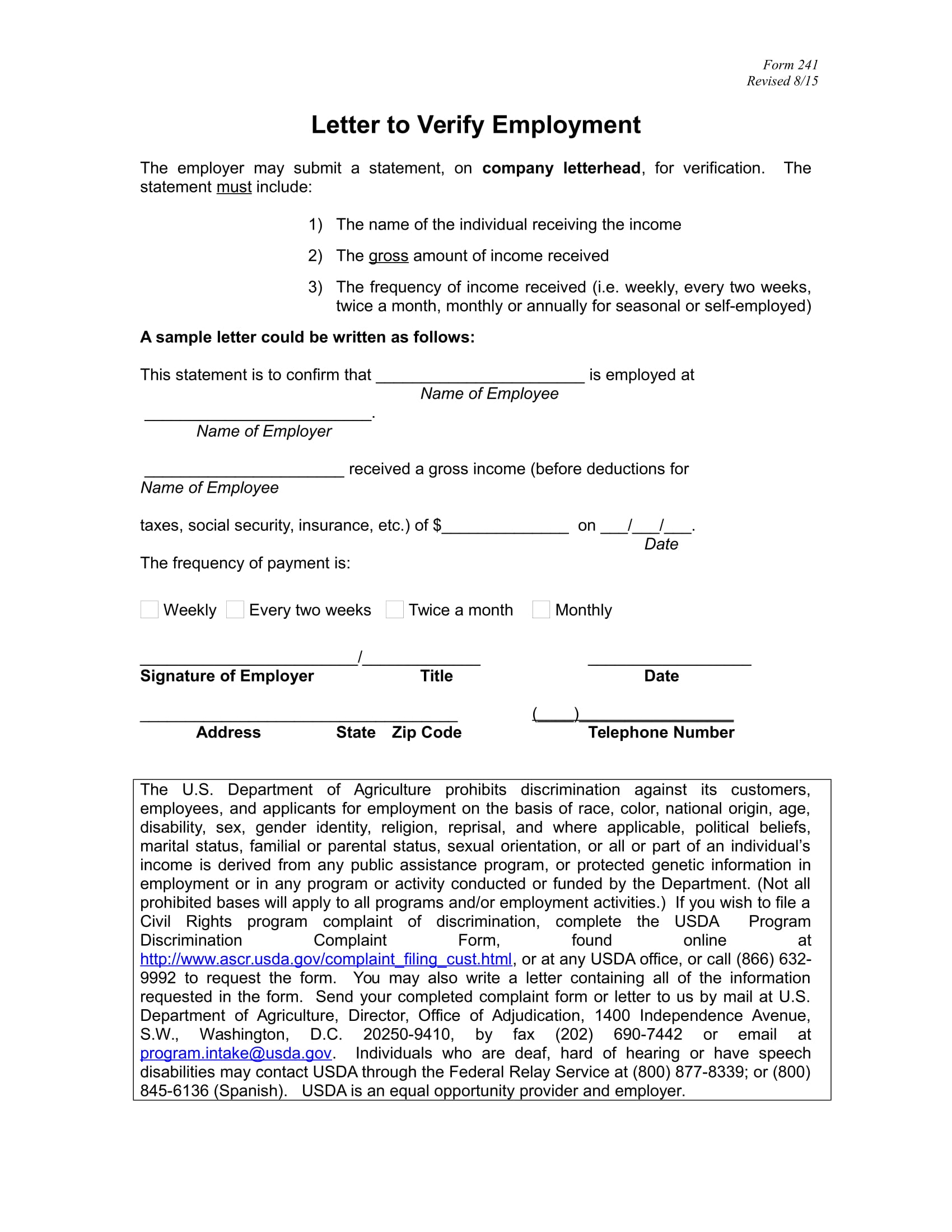

Income Verification Letter 9 Examples Format Sample Examples

How Much House Can You Afford Readynest

Proof Of Income Letter Examples 13 In Pdf Examples

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Walmart S Food Stamp Scam Explained In One Easy Chart Jobs With Justice

Free 53 Payment Letter Formats In Ms Word Google Docs Pages Pdf

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

How Much Home Can You Afford Advanced Topics